Download our TS Lombard View "Why we remain bears"

by Charles Dumas, Chief Economist

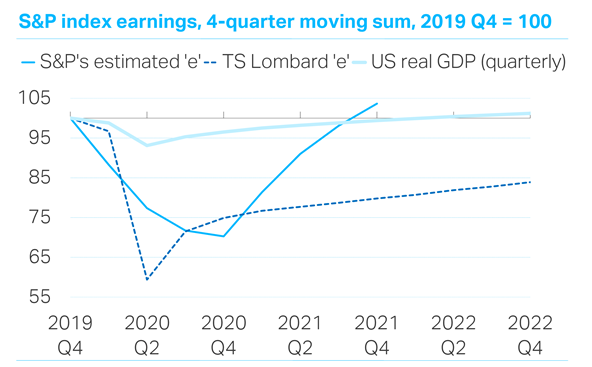

We remain convinced bears – index down at least 20% is our starting point. Investor belief in full ‘e’ recovery in 2021 contradicts economic outlook, we see 2021 earnings still 20% down from 2019. Such is the self-confidence driving stock prices higher that the comparison of current forward p/e ratios to their only precedent, the 1999-2000 tech bubble, suggests a comparison with the 2½-3-year bear market that slumped in 2000 and finally ended in early 2003. Asset prices are over-boosted by the monetary-policy monopoly that has been driven since 2011. Shift to Keynesian deficits = less ultra-easy money in future, which will undermine overvalued stock prices going forward.

Client Login

Client Login Contact

Contact