Download Dario Perkins' Macro Picture "K-Runch Time"

We’ve written a lot on the K-Shaped recession and it’s dispersive effects, this time we highlight the “winners” that investors should look to pick.

Massive disparity has become the theme of the COVID-19 (“K”) recession, diluting the traditional link between asset prices and the real economy. Recessions usually add to inequality, but the pandemic is interacting with powerful secular forces to create an unprecedented divide. Central banks will adjust their mandates but this will be ineffective without unwavering fiscal support.

We see the COVID “K” across a range of dimensions, including:

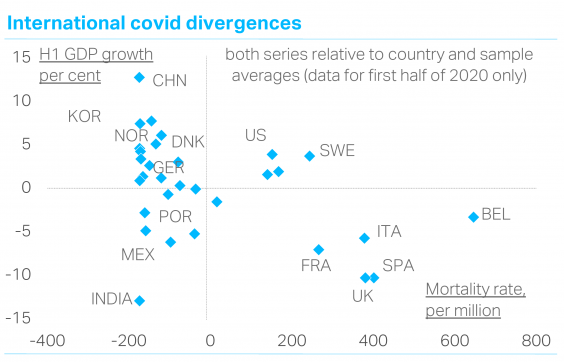

- internationally – some countries seem better able to handle the virus than others;

- by demographics – the old are most vulnerable to the disease, but it is the young that have been losing their jobs;

- by educational attainment/skills – the demand for high-skilled workers has stayed resilient in 2020 and most have been able to work remotely, but this has not been the case for those with fewer qualifications;

- according to wealth – the booming stock market has bolstered the net worth of the top 1%, but since the wealthy have also increased their saving, the cash has not found its way back into the real economy; and:

- across corporates, with the superstars escaping a crisis that has hit SMEs particularly hard.

Investors will need to make sure the pick the winners in this new environment. Internationally, we prefer the stock markets of countries that seem to be capable of containing the virus while simultaneously limiting the economic damage: China, E Asia, Germany and the Nordics. But once the authorities lose control, e.g. in the UK, both the health costs and the economic costs spiral higher. Equity sectors - digital technologies will continue to gain market share. This means US equities could continue to outperform “macro fundamentals”, resilient even in the face of a persistent macroeconomic slump and severe COVID-19 policy failings.

Monetary policy will not be sufficient to stoke inflation – regardless of central banks current intentions, bonds aren’t exciting. Furthermore bonds are no longer a hedge against equities given that the zero bound is constraining long-term yields. Investors will need to find alternative to ways to diversify their portfolio, including precious metals, real assets and even currencies.

Client Login

Client Login Contact

Contact